Currently the candles sold in the US total an estimated yearly income of more than $3 billion dollars and is growing every year. Candle sales have currently increased every year for the last several years. Some candle manufacturers are even experiencing labor and material shortages at the moment, struggling to keep up with demand. However, during the holiday season, you will see a big push for mason jars in most regions of the country. If you check the best selling fragrances by region and any of the major fragrance oil suppliers websites.

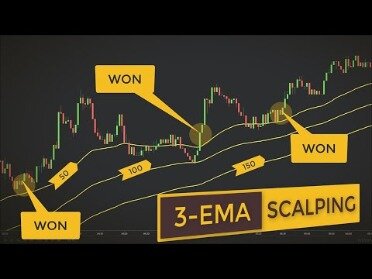

What is a Doji candle pattern and how to trade with it? – Cointelegraph

What is a Doji candle pattern and how to trade with it?.

Posted: Mon, 12 Dec 2022 08:00:00 GMT [source]

In the bullish engulfing, a red candle is dwarfed by the green one that follows it. The upper wick shows that buyers took control of the market within the session, but were met with resistance from the sellers. However, sellers were unable to push its price further down, meaning that bearish sentiment may be on the wane.

What are candlesticks in forex?

Triple candlestick patterns are often seen as some of the strongest signals of an upcoming move. A short red body with a high upper wick, meanwhile, indicates that bulls pushed a market’s price higher, but were beaten back by bears before close. And if there’s no wick at all, you know that the open or closing price was also the high/low. First of all, you have to mark up your major swing points that are formed by the institutional candle.

Every candlestick pattern body reflects the opening and closing stock prices during the selected trading period. Those starting off newly in the stock markets can look at the price range of a selected stock using these patterns. It is a bearish signal that the market is going to continue in a downward trend. Learning to recognize the hanging man candle and other candle formations is a good way to learn some of the entry and exit signals that are prominent when using candlestick charts. The hanging man candle, is a candlestick formation that reveals a sharp increase in selling pressure at the height of an uptrend. It is characterized by a long lower wick, a short upper wick, a small body and a close below the open.

Popular Calculators

Confirmation of a short signal comes with a dark candle on the following day. Candlestick charts are a technical tool that packs data for multiple time frames into https://trading-market.org/software-development/ single price bars. This makes them more useful than traditional open, high, low, and close (OHLC) bars or simple lines that connect the dots of closing prices.

- Yes, candlestick analysis can be effective if you follow the rules and wait for confirmation, usually in the next day’s candle.

- The abandoned baby pattern is a 3-bar reversal pattern.The bullish abandoned baby follows a downtrend.

- The wicks are an asset’s high and low price, and the top and bottom of the candle are the open and close price.

- A Long-Legged Doji pattern is the one that has a closing and opening price happening at or in the middle of the shadows.

The pattern shows that the bullish market condition is pushing the prices up despite a lower opening on the previous day. Such patterns are mostly seen at the end of a market consolidation phase. The three inside up pattern is another trend reversal indicator, appearing after a downtrend and signalling the beginning of a https://forex-world.net/software-development/coral-dev-board-tpu/ potential reversal. In the engulfing pattern, a candlestick is immediately followed by another larger one in the opposite direction. A shooting star, meanwhile, is a doppelgänger of an inverted hammer. But like the hanging man, a shooting star will appear at the crest of an uptrend instead of the trough of a downtrend.

Forex Candlesticks: A Complete Guide for Forex Traders

The Bearish Harami is a multiple candlestick pattern formed after the uptrend indicating bearish reversal. The Three Inside Down is multiple candlestick pattern which is formed after an uptrend indicating bearish reversal. The Three Black Crows is multiple candlestick pattern which is formed after an uptrend indicating bearish reversal. The Three Outside Up is multiple candlestick pattern which is formed after a downtrend indicating bullish reversal.

Dojis by themselves tell us that there is indecision on the price but does not tell us much beyond that. Although, if using them with other candle stick patterns, you might be able to learn more about how the stock price is going to move. Two of patterns are the morning doji star and the evening doji star. At one point, buyers were winning and at one point sellers were winning but it ended up closing at the same price as when it opened.

Triple candlestick patterns

The pattern is called a neckline because the two closing prices are the same or almost the same across the two candles, forming a horizontal neckline. An Inverted Hammer is formed at the end of the downtrend and gives a bullish reversal signal. This bullish reversal is confirmed the next day when the bullish candle is formed. The bottom-most candles with almost the same low indicate the strength of the support and also signal that the downtrend may get reversed to form an uptrend. Due to this the bulls step into action and move the price upwards. This resulted in the formation of bullish pattern and signifies that buyers are back in the market and downtrend may end.

A mat hold pattern is a candlestick formation indicating the continuation of a prior trend. It is formed when both the bulls and bears are fighting to control prices but nobody succeeds in gaining full control of the prices. The third candlestick should be a long bearish candlestick confirming the bearish reversal. It consists of two candlesticks, https://currency-trading.org/strategies/5-best-algo-trading-strategies-that-truly-work/ the first one being bullish and the second one being bearish candlestick. Traders can take a short position after the completion of this candlestick pattern. It consists of three candlesticks, the first being a long bullish candle, the second candlestick being a small bearish which should be in the range the first candlestick.

The institutional candles work because these are the drawdown of smart money. So, there must be somebody on the other side to take the trade. That’s why market moves and institution candle comes to play as a fishing worm of smart money to grab the liquidity. Traders typically look for the breakout to occur in the direction of the old trend.

This idea comes from a simpler candlestick concept called thrusting lines. For example, if there is an uptrend, if a down candle forms but stays within the upper half of the last upward candle, little damage is done to the trend. The upside gap two crows candlestick pattern is a 3-bar bearish reversal pattern.It appears during an uptrend. Statistics to prove if the Upside Gap Two Crows pattern really works What is the upside gap two crows candlestick…